Keep reading to learn all about RECs and how they work with solar power.

What are Renewable Energy Certificates?

Renewable Energy Certificates (RECs) are a type of renewable energy currency issued under the Australian Government’s Renewable Energy Target (RET) scheme. They are designed to encourage investment in renewable energy systems (like solar panels) by offering a way to recoup installation costs based on the system’s performance.

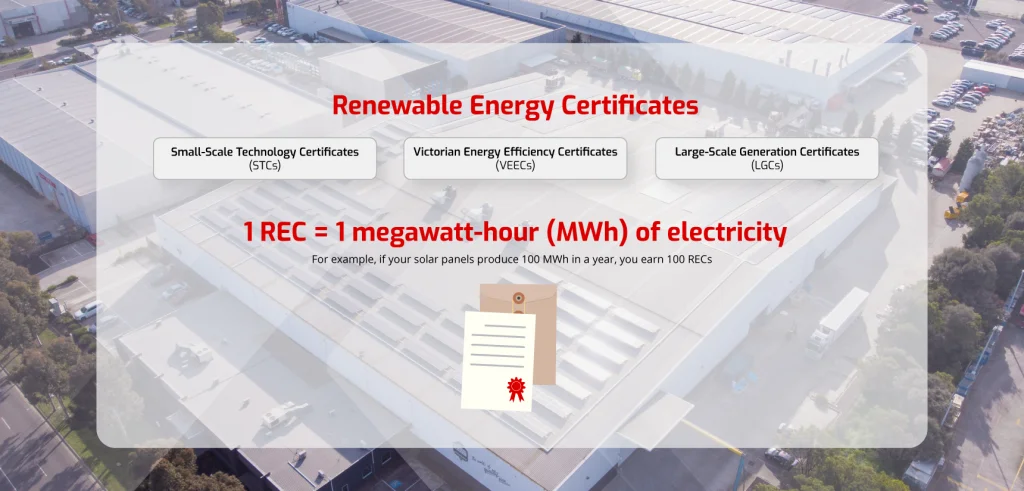

Prior to 2011, RECs were calculated as a single commodity. Since then, RECs have been split into two types: Small-Scale Technology Certificates (STCs) and Large-Scale Generation Certificates (LGCs).

There is also a third type of certificate known as Victorian Energy Efficiency Certificates (VEECs). As the name suggests, these are exclusive to Victoria.

How do Renewable Energy Certificates Work?

1 REC is equivalent to 1 megawatt-hour (MWh) of electricity generated by your renewable energy system. For example, if your solar panels produce 100 MWh in a year, you earn 100 RECs.

RECs operate in a similar way to the stock market. Like stocks, RECs have a cash value that fluctuates with the market and can be sold or traded between entities.

You can claim and barter RECs yourself by completing the necessary paperwork, but it can be complex and time-consuming if you aren’t experienced. When you upgrade to commercial solar with Kuga Energy, we can handle all of this on your behalf, allowing you to get the maximum discount on your solar installation without going through all the red tape.

As mentioned, there are three types of RECs your business can claim (STCs, LGCs, and VEECs). Let’s examine how each of them works:

STCs

STCs are governed by the Small-scale Renewable Energy Scheme (SRES) for solar arrays under or equal to 100kw. STCs are provided upfront for the system’s expected power generation between the date of installation and 2031 (when the scheme ends).

For example, let’s say your new 100kw solar system is estimated to produce 1500MWh of electricity between the date of installation and 2031. This means you are entitled to 1500 STCs. If STCs are valued at $35 at the time, then you will get $35 x 15000 ($52,500) as an upfront discount on your solar installation.

Act fast: The Federal Government is reducing the value of STCs by around 6-7% every year until the scheme ends. This means you need to act fast to get the best possible discount on your small-scale solar installation.

LGCs

The next tier up, LGCs can be generated for new or existing solar systems rated over 100kW under the Large-scale Renewable Energy Target (LRET). In contrast to VEECs (which we’ll cover next), LGCs can be generated whether the electricity generated is used exclusively by your business or sold back to the grid.

Just like STCs, LGCs are equal to MWhs generated and can be traded on a national market, causing their value to fluctuate. However, unlike STCs, LGCs are created on an ongoing basis. This means that with LGCs, you’ll get a yearly rebate rather than an upfront discount.

For example, if the yearly energy output of your 200kW solar array is 300MWh, then you’ll get 300 LGCs every year. As of writing, the average price of LGCs is hovering around $471. This means that your yearly rebate would be around $14,100.

To create and trade LGCs, you need to apply to register your solar system as an ‘accredited power station’ + apply to become a ‘registered person’ under the REC Registry. LGCs rely on a general formula you need to use to report your system’s monthly energy production to the REC Registry before you can claim your certificates.

Upfront LGC rebate: If registering and trading LGCs sounds too complicated and time-consuming, you can let the experts at Kuga Energy do it for you! When you install your new solar system with us, you can choose to have us pay you your expected LGC revenue upfront and take the burden and risk of trading the certificates off your shoulders.

Surrendering LGCs: Under the RET scheme, liable entities (large purchasers of electricity like energy companies or large energy users) are required to surrender LGCs receive carbon credits (proving they are reducing their carbon footprint). Many large organisations rely on purchasing LGCs from smaller generators to abate their carbon footprint, which is what drives their demand (and price).

When you generate LGCs with your solar panels, you can choose to voluntarily surrender them rather than sell them, offsetting your carbon footprint and helping your business achieve carbon neutrality. The downside of this is that you won’t be financially compensated.

This is the essence of the LGC marketplace; big energy users compensate you for offsetting carbon for them so they can meet their annual obligations.

Victorian Energy Efficiency Certificates (VEECs)

Created by the Victorian Energy Upgrades (VEU) program, VEECs are fundamentally different from STCs and LGCs in that they are calculated by tonnes of greenhouse gas emissions offset by your solar system rather than by how much power it generates. You can use the VEU’s VEEC calculator to get an approximation of how many VEECs you can create.

In contrast to LGCs, VEECs can only be created for energy used on-site to power your business and won’t count for any energy that you export.

VEECs are considered a ‘hybrid’ REC because they are measured for a year but deemed for the entire decade. This means that after a year of seeing how much carbon your solar panels offset, this number will be projected over the next nine years to calculate your VEECs. Your business can then cash in ten years’ worth of VEECs at once.

Compared to LGCs, VEECs are worth around twice as much and are paid out much faster, making them a far superior choice if your business is based in Victoria. Another advantage of VEECs over LGCs is that, as a part of a white certificate scheme, you can still claim carbon credits even after your trade them in for cash. So, with VEECs you get to reduce the expense of your solar system AND work towards carbon neutrality at the same time.

VEEC rebates with Kuga: Just like the other two RECs, you can either go through the process of registering and trading VEECs yourself or allow Kuga Electrical to handle this on your behalf. We can give you an upfront payment for your expected VEEC revenue, or you can lock in the certificate price and have it paid when the VEEC measurement and claim process is finished (around 12-15 months after your solar panels are switched on).

Reap the Rewards of RECs the Easy Way

RECs have proven essential for making commercial solar viable for thousands of Australian businesses that otherwise couldn’t justify the upfront expense. Without them, Australia wouldn’t be the renewable energy leader it is today.

However, if you’re like most business owners, you probably don’t have the spare time to learn everything about generating or trading these certificates to get your rebate. Luckily, Kuga Energys’ renewable energy experts can do everything for you no matter what size of solar installation your business needs.

Learn more about business solar rebates, or get in touch with the Kuga team to discuss how we can get you set up with commercial solar quickly and affordably.

Sources:

1: https://www.demandmanager.com.au/certificate-prices/

Get Quote

Get Quote Call Now

Call Now